Employer Resources Newsletter - June 2023

HR Best Practice: Conflict and Dispute in the Workplace on the Rise

In May 2023, Adare Human Resource Management launched their most recent HR Barometer Key Findings from a national pulse survey impacting 33,000 employees. In that our research found that almost 7 out of ten (69%) organisations experienced workplace conflict in 2022, up from 46% in 2021 from our HR Barometer Series 6.1.

“Discipline” ranks as the main employee-related issue with one in two (52%) stating that it was an issue last year, up from 31% in 2021. This is not surprising given the impact of blended working practices as employees continue to re-integrate into more permanent ways of working.

Incidence of “Grievance” is also up from 29% in 2021 to 45% last year, which again can be seen as an impact from blended working practices. What is of paramount importance is that transparent communication pathways are enabled so that clarity of expectations and changes to working practices support the practice of blended working.

Some concerning findings relate to the significant increase in investigations having to take place with 41% of organisations conducting formal investigations in 2022 in comparison to 18% the previous year. With the increase in investigations comes additional obligations on employers to ensure that up to date policies and procedures are in place as well as compliant practices being applied when formal interventions are being implemented.

The Workplace Relations Commission recently published their Annual Report and with that comes some key insights into the number of complaints being processed through the mechanisms of the third party. They too have seen a significant increase in adjudications, citing that over the course of 2022, the number of hearings held, and decisions issued by the WRC Adjudication Service each increased by almost 30%.

Actions for nonprofit organisations

So, while conflict and disputes are unavoidable in the workplace, understanding the causes of conflict and disputes among co-workers will help to resolve them. In the majority of situations, disagreements or misunderstandings can be dealt with swiftly and informally without any disruption to the organisation. Equipping managers with the skills needed to identify and address potential issues, will allow them to intervene early and prevent any escalation.

Having clear discipline and grievance policies and procedures in place provides the channels for work-related issues to be managed formally and fairly. While we’ve already acknowledged that it is very difficult to avoid workplace conflict, fostering a culture of openness, fairness and transparency will help establish a more harmonious work environment. Importantly ensuring your organisation has the necessary skillset in manging conflict and dispute is the foundation of compliant practices. As when a gap exists that is when the risks increase, and financial liability can ensue.

If you require advice or guidance in managing conflicts and disputes or support in the application of compliant policies and procedures contact the team at Adare Human Resource Management for more information on how we can help and the supports available under our Partnership Programme. https://www.adarehrm.ie/

WRC / Labour Court Decisions

Award of nearly €20,000 to employee under the Payment of Wages Act

Background:

The Complainant stated that he was not paid salary from January 2020 until July 2021 contrary to the provisions of the Payment of Wages Act 1991 and that he is owed holiday pay and expenses. The Complainant further stated that he did not receive a statement of his terms and conditions of employment contrary to the Terms of Employment (Information Act) [1994-2020]. These complaints are disputed and rejected by the Respondent.

Summary of Complainant’s Case:

The Complainant commenced employment with the Respondent in 2017 as an outreach worker. The Complainant stated that the Respondent provided rehabilitative support for those exiting the criminal justice system through the use of community employment schemes, training and various education initiatives.

The Complainant outlined the background to his complaint including in respect of a protected disclosure which he made in 2018 and High Court proceedings which he had initiated. Between September and December 2019, the Complainant took periods of sick leave for various reasons but stated that he returned to work on Monday, 2 December 2019 having been certified fit to do so by his GP. He stated that he provided a medical return to work certificate. The Complainant submits that the Respondent acknowledged his return to work by conducting a return-to-work meeting with him on December 3, 2019. Thereafter, the Complainant stated that he stayed at work until he took annual leave from December 9th until 27 December 27th, 2019 – and that he was paid his usual salary for all of December 2019.

On the December 20, 2019, the Respondent wrote to the Complainant in relation to his contract renewal and advised him not to return to work after his Christmas holidays and “until such time as his contract renewal was finalised”. In the letter the Respondent invited the Complainant to a meeting scheduled for January 9, 2020. This meeting did not take place and there were further exchanges between the Respondent and the Complainant in relation to arranging a proposed meeting, which in fact never took place. However, it is the position of the Complainant that at all times he “readily engaged with the Respondent as regards the holding of such a meeting”.

The Complainant stated that on the August 27, 2020, the Respondent wrote to him and advised that it had instigated a formal investigation into certain instances of alleged misconduct on his part including his absence from work in the period from 2019 into 2020 and the matter of the provision of medical certification. Terms of Reference were provided for the investigation and the Complainant stated that he fully co-operated with the process which was conducted by a third party on behalf of the Respondent. The investigation was completed on the May 7, 2021, and the conclusion found that the Complainant had no case to answer in respect of all the allegations. Thereafter and by agreement with the Respondent, the Complainant returned to work on 19 July 2021, was restored to the payroll and was granted a Contract of Indefinite Duration (CID).

It is the position of the Complainant that on foot of the direction contained in the Respondent’s letter to him of the December 20, 2019, he was not permitted to return to his employment between 27 December 2019 and 19 July 2021 notwithstanding his willingness and availability to do, that effectively he was on unpaid suspension from work during this time which he stated was wholly unjustified, in breach of fair procedures and constituted an unlawful deduction of his wages contrary to the Payment of Wages Act 1991. The Complainant submitted that at all times he continued to be in the employ of the Respondent and that the Investigator had confirmed this to him as otherwise a workplace investigation could not have been undertaken during 2020/2021.

The Complainant stated that his annual gross salary was €39,992.00. At the adjudication hearing he stated that he was fully paid for December 2019 and that he was seeking the amount of €61,795.85 in respect of 565 days of unpaid wages – i.e., from 1 January 2020 until his return to the payroll on 19 July 2021. The Complainant is also seeking €461.42 in holiday pay owed since 1 January 2020 together with work related and travel expenses for the amount of €4,869.

The Complainant stated that in 2019 and 2020, he had repeatedly but unsuccessfully requested copies of his contracts of employment but was advised that his request could not be processed whilst the issues relating to his return to work remained outstanding. In particular the Complainant referred to the failure to provide him with a contract of employment for the year 2020.

Summary of Respondent’s Case:

The Respondent stated that it was a charitable and non-profit organisation providing support services for offenders, ex-offenders and those at risk of offending and their families to facilitate full participation in community and economic life. The Respondent stated that it relied on government funding and accordingly it was not always possible to make roles permanent as these were subject to funding which was reviewed on a regular basis.

The Respondent disputes and denies that the Complainant is owed wages for the period January 2020 – July 2021 and maintains that he had no entitlement to payment during this time as he had not provided the correct medical certification of fitness to return to work in December 2019 and in any event, his fixed term contract expired on 31 December 2019, and he was therefore out of contract after that. The Respondent outlined the Complainant’s sick leave towards the end of 2019. In that regard, the Respondent stated that on the 17th October 2019, the Complainant’s Medical Practitioner stated that he would be fit to return to work as of 1 December 2020 but that due to the length of intervening time, on 28 November 2019 the Respondent requested the Complainant to provide a medical certificate of fitness to return to work. The Respondent stated that on 3 December 2019, the Complainant provided a social welfare illness form and that was informed that this was not a fitness to return to work medical certificate.

In addition to its consideration of the Complainant’s medical certification, the Respondent stated that it also needed to review the Complainant’s role. The Respondent stated that it had issues to discuss with the Complainant and that it wrote to him on 20 December 2019 informing him that his contract was due to expire on 31 December 2019 and that it sought to arrange a review and consultation meeting with him regarding the outstanding issues.

Thereafter, there followed an exchange of correspondence between the Complainant/his representative and the Respondent in relation to the matter of the Complainant’s fitness to return to work, the provision of a medical certificate of fitness to return and the issue of arranging a review meeting with the Complainant. Ultimately no direct meeting took place between the Complainant and the Respondent.

The Respondent initiated an investigation conducted by a third party in relation to various allegations concerning alleged absence from work and alleged failure to follow certain of the Respondent’s policies and procedures. The Investigator found that the Complainant had no case to answer with regard to all of the allegations and thereafter he returned to work in July 2021.

It is the position of the Respondent that the Complainant’s fixed term contract expired on 31 December 2019 and that he was out of contract until he returned in July 2021. The Respondent stated that the Complainant had “failed to renew or consult on any contract beyond 31st December 2019.” The Respondent also stated that the Complainant “[had] failed to provide the Respondent with a medical certificate to excuse his absence, to make way for any discretionary sickness payment to be made to him”. Further, the Respondent stated that the Complainant failed to perform any work between January 2020 and July 2021 and accordingly, no wages were due to him. In addition, the Respondent maintained that the Complainant could not have accrued annual leave during this time. In relation to expenses, the Respondent stated that the Complainant did not provide receipts, that the expenditure had not been authorised in accordance with the Respondent’s expenses policy and that such complaint was outside the scope of the Payment of Wages Act 1991.

The Respondent denied that it had not provided the Complainant with a statement of his main terms and conditions. In that regard, the Respondent stated that it had provided the Complainant with a contract of employment – which the Complainant had signed - for each period of employment. The Respondent cited various Statements of Terms of Employment signed by the Complainant on the 16th June 2017, 26th November 2018 and 6th June 2019 to reflect different periods of employment up to the end of 2019 and to its Induction Document signed by the Complainant on the 19th June 2017. Accordingly, the Respondent maintained that the Complainant was at all times aware of his terms and conditions of employment - for example - in relation to his pay, sick leave, pension and various policies and/or collective agreements. The Respondent stated that the Complainant was out of contract for 2020 but had received a new contract when he returned to work in July 2021.

Findings and Conclusions:

Having given careful consideration to the submissions and evidence, the Adjudicator is satisfied that the events in this case are for the most part not in dispute including that the Complainant was not paid any wages from 1 January 2020 until his resumption on 19 July 2021. In his evidence the Complainant was clear that he returned to work on 2 December 2019, and he stated that he had acted in good faith in relation to his medical certification and had provided the appropriate return to work certificate. The Adjudicator was furnished with a copy of a medical certificate from the Complainant’s GP dated 17 October 2019 which covered the period 17 October 2019 until 30 November 2019 and stated as follows: “Additional Note: Fit to return 01/12/20”. The Complainant stated that the date of 1 December 2020 was a mistake by the doctor and that it was clear it was intended to be 1 December 2019. The Complainant stated that this could have been clarified by a phone call. The Complainant also stated that he could not access social welfare payments during 2020 including the PUP as the Respondent had stated he was on sick leave.

For its part, the Respondent was not satisfied with the medical certification provided – including that it was not provided in a timely manner, i.e., proximate to the date of return of 1 December 2019 and that it was incorrectly dated. The Respondent was also concerned that the document provided by the Complainant on 3 December 2019 did not constitute a medical certificate of fitness to return to work. A number of other specific issues were raised by the Respondent with the Complainant in relation to the provision of medical certification. In all the circumstances, the Adjudicator is of the view that an employer is entitled to query a medical certificate or seek further independent medical opinion.

The Adjudicator has noted that in the course of the hearing an issue arose as to whether the Complainant was suspended during 2020 but this was disputed by the Respondent who stated in evidence that reference to suspension in a letter of 17 June 2022 sent on its behalf was “mis-spoken”.

In the instant case the Respondent has submitted that the Complainant was out of contract from 1 January 2020, that he did not comply with policy and the requirement to submit appropriate medical certification and that in any event, he performed no work during 2020. The Adjudicator cannot accept the Respondent’s approach in this regard for the following reasons:

-

the Adjudicator is satisfied from the evidence that the Complainant returned to work on the 2nd December 2019, that he remained at work for a number of days before taking annual leave and that he was paid his usual wages for all of December 2019. Accordingly, the Adjudicator is of the view that any concerns about the Complainant’s medical fitness to return to work should have been addressed by the Respondent prior to his return;

-

The Respondent continued to engage with the Complainant from 1 January 2020 and throughout 2020 as if he was an employee. In all the circumstances, the Adjudicator is satisfied from the course of dealings between the Respondent and the Complainant from 1 January 2020, that the Complainant was not out of contract and that the employment relationship continued in 2020;

-

The Respondent’s letter to the Complainant of the 20th December 2019 advised him “that as [his] contract will expire on the 31st December 2019, [he] should not attend for work in the intervening period”. Irrespective of the issue of medical certification, the Complainant had no alternative but to comply with this direction from the Respondent. As the Adjudicator has already concluded that the employment relationship between the Complainant and the Respondent continued after the 1st January 2020 and as the Respondent clarified that the Complainant was not suspended from work, the Adjudicator finds that this direction had the effect of excluding the Complainant from his workplace resulting in an unlawful deduction of the wages which were properly payable to him contrary to the provisions of the Payment of Wages Act 1991.

In the instant case, from the evidence and submissions the Adjudicator is persuaded by the Respondent’s position that the Complainant was furnished with and signed various statements of terms of employment up to 2019 and the Adjudicator also accepts that he was provided with an employee/induction handbook. Having concluded however, that the Complainant continued to be an employee of the Respondent during 2020, the Adjudicator finds that he was not furnished with any type of contract or statement of terms of employment from 1 January 2020.

Decision:

For the reasons outlined this complaint is well founded. The Adjudicator finds that the non-payment of wages to the Complainant for the period 1 January 2020 to 28 May 2020 constituted an unlawful deduction contrary to the provisions of the Payment of Wages Act. Based on the Complainant’s annual gross salary was €39,992.00, the Adjudicator orders the Respondent to pay the Complainant €16,305.00 being the gross amount which should have been payable to the Complainant for the period 1 January 2020 to 28 May 2020, subject to such statutory deductions as may apply.

Based on the formula of 8% hours worked for the period 1 January – 28 May 2020, the Adjudicator orders the Respondent to pay the Complainant the gross amount of €1,304.29 in holiday pay, subject to such statutory deductions as may apply.

For the reasons outlined this complaint is well founded in respect of the year 2020. Based on the Complainant’s annual gross salary of €39,992.00, the Adjudicator orders the Respondent to pay the Complainant €2,307.21 which is considered equivalent to three weeks remuneration – and this is subject to such statutory deductions as may apply.

Our Commentary:

There were a number of issues arising from this case, the first and most pertinent was the delay in the contract renewal. The Act provides that where an employer proposes to renew or extend a fixed term / purpose contract the employee shall be informed in writing, not later than the date of renewal, of the objective grounds justifying the renewal of the fixed term / purpose contract and the failure to offer a contract of indefinite duration at that time. When renewing or extending a fixed term / purpose contract it is a legal requirement that the employer advises the employee, in writing prior to the expiry of the current contract, of the fact that the contract is to be renewed. The legislation requires that the employer outline the objective reasons for renewing the fixed term / purpose contract and not offering permanent employment at the time. A failure to provide this will not leave an employer liable to a fine, however, where an employee pursues a claim for permanency, the employer’s case will be severely weakened by their absence.

Along with the requirement for justifying the renewal of a fixed term / purpose contract, the Act also regulates the length of the successive fixed term contracts in determining the employee’s right to a contract of indefinite duration. Fixed term / purpose contracts may only be used for a specific period of time, otherwise the employee may become entitled to a contract of indefinite duration. The entitlement is dependent upon the date of commencement of employment.

In this case the impact of not having in place a contract or at the very least clarity around the status of the employment led to an eventual unlawful deduction. Under the Act, where any non-payment of wages arises or a deficiency in the amount of wages properly payable by an employer to an employee on any occasion will be automatically deemed an unlawful deduction from wages, unless the deficiency or non-payment is attributable to an error of computation which in this case was not the situation arising.

Did You Know?

Workplace Relations Commission Annual Report

In May the Workplace Relations Commission (WRC) published its Annual Report for 2022, providing insights into the state of employment claims, highlighting trends, problems, and improvements in the labour market over the past year. With the number of complaints received and adjudication hearings held on the rise, the report acts as a stark reminder of the litany of risks that exist when managing conflicts and disputes in the workplace.

The employment landscape remains challenging for employers and in the current environment it is essential that pragmatic decisions are being made to limit the risks that may unfold in the future. From a strategic planning perspective there is a necessity for employers within the non-profit sector to re-prioritise organisational objectives in the medium and long term in order to prepare for the future and meet challenges such as retention and talent acquisition head on. The publication of the Workplace Relations Commission 2022 Annual Report comes as a timely reminder of those risks and acts as a cue to ensure employers are acting in a manner that not only serves the organisation but also their people.

What we learned from the 2022 Annual WRC Report

Summary of the main key finding are:

-

The WRC’s information line dealt with almost 60,000 calls in 2022, an increase from 2019 when pre-pandemic, the WRC dealt with 55,000 calls.

-

The WRC website handled over four million page views, a 23% increase on 2021.

-

The Inspectorate of the WRC recovered €1.4 million in unpaid wages for employees and carried out 5,820 inspection visits and in the course of these inspection visits over 5,700 specific contraventions of legislation were detected.

-

The number of hearings held, and decisions issued by the WRC Adjudication Service each increased by almost 30%.

-

The WRC’s Conciliation Service resolved 88% of disputes on which it conciliated.

-

There was also a 30% increase in parties willing to engage in mediation.

Adjudication Services

Within the WRC is the Adjudication Service which specifically investigates disputes, grievances, and claims made by individuals and groups under employment, equality, and equal status legislation.

This service reported that during 2022, some 6,263 complaint applications were received which comprised 12,790 individual complaints - an average of two specific (individual) complaints per complaint application. This represented an increase of 4.5% and 6.5% respectively for complaint applications and individual complaints compared with 2021.

Complaints Received

Specific Complaints by Complaint Type

-

3,363 (26%) related to Pay.

-

1,851 (14%) related to Discrimination, Equality & Equal Status.

-

1,518 (12%) related to Unfair Dismissal.

-

1,222 (10%) related to Terms & Conditions of Employment complaints.

Referrals Under the Employment Equality Act, 1998-2015

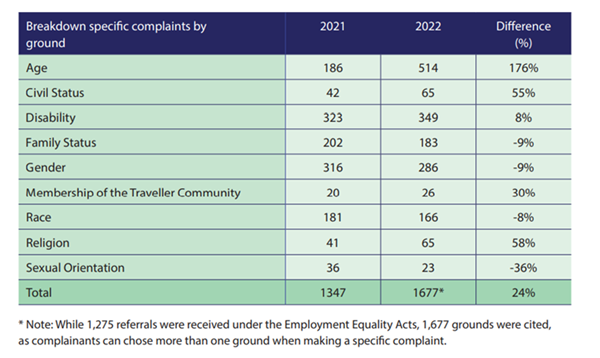

In particular, there were 1,275 complaints filed under the Employment Equality Act, with 1,677 specific reasons of discrimination cited.

This represents a 37% increase in referrals under the legislation over 2021 (932) when 1,347 specific grounds were specified.

Within the overall referrals, the highest increase was related to Age Discrimination (514) a significant increase of 176% compared to 2021.

Managing an Aging Workforce and Avoiding Age Discrimination

The Irish workforce is getting older and according to the Central Statistics Office, there will be approximately 1.5 million individuals aged 65 and older in Ireland by 2051. With age discrimination claims on the rise, it is essential that employers are consistent in their application of inclusive practices throughout the employee lifecycle.

Employers in the non-profit sector should take action to address discrimination in the workplace including not only the implementation of clear policies under Equal Opportunity but also by providing diversity and inclusion training, detailing unconscious bias for better understanding, and ensuring inclusive practices remain to the fore. Employers should also have robust Dignity at Work policies and procedures in place to ensure all concerns of harassment are addressed in an appropriate manner and in order to guide employees on how to report incidents of discrimination. Where any concerns arise employers in the non-profit sector must take swift and appropriate action against those who engage in any discriminatory behaviour.

Discrimination in the workplace is a serious issue that employers must address. Employers who create an inclusive workplace culture often reap the benefits of increased employee morale and productivity, leading to a more successful organisation. Employers who actively work to create a diverse and inclusive workplace will not only benefit their employees but should also see their organisations thrive. Staying compliant with legislative requirements is the first step and employers must ensure adequate protections are in place for employees through the deployment of appropriate skills in managing complaints and promoting inclusive practices.

If you have any queries about strategic workforce planning to avoid the pitfalls and mitigate the risks of complaints of discrimination, contact the team at Adare Human Resource Management to discuss further.

If your organisation requires support, advice or guidance on developing and implementing policies and procedures, employee relations support or details of the supports provided under our Partnership Programme contact our expert-led team at Adare Human Resource Management.

Dublin Office: (01) 561 3594 | Cork Office: (021) 486 1420 | Shannon Office: (061) 363 805

info@adarehrm.ie | www.adarehrm.ie